Do you know your customers? Your answer to that question might be “Yes, we know our target audience and what they want––we did a survey last quarter!” But if we were to press you a bit further on that question, we might find that your team is only able to give us surface-level information––like facts around age, marital status, income, profession, and other basic demographics––instead of rich human-centered insights about who your customers (or users) really are, what motivates them, what bugs them, what their fears are, and what they really need.

Surveys are one of the most common forms of market research conducted by companies today––but why is that? Well, it’s simple. Surveys are relatively easy to create and distribute, especially if you have a big contact list. Yet there is only so much a survey can reveal before you need to dive deeper (with further user research) and get to know your customers on a more “human” level. Don’t get us wrong––we use surveys regularly in our work, too! They are a key user experience (UX) and design research tool as well. But when used in isolation (as the only form of gathering customer data) or from a purely market research perspective, you will really only get half the story. You can certainly ask about a customer’s overall satisfaction, what they enjoy or dislike the most about a product/service, details about age and location, or whether they would refer your company to a friend. But you won’t get at their “WHY” this way. Why do they enjoy your service or product? Why do they dislike a certain part of the experience? What do they really need? Surveys are most useful when backed by further in-depth UX research.

At the same time, many assume that high-level facts about their customers are all they need, and that it is possible to make key product decisions purely from information gathered by a 1000+ respondent survey (because yes, that’s a lot of people!) Why would you need to know these customers on a more individual basis? Why would you need to know about their lives, and about what bothers them?

The fact is, once you can better understand your customers’ deeper needs and wants, as well as what motivates them, you’ll actually be opening your company up to SO many new product and feature opportunities.

Market Research vs. UX Research

So what’s the big difference, anyway?

Well, in the context of market research, surveys are very important for:

-

Providing information about possible target demographics

-

Determining product or brand perceptions/expectations, and

-

Uncovering whether an idea is actually viable.

Whereas user experience (UX) research seeks to identify:

-

User behaviours

-

Unspoken (hidden) needs

-

Goals and motivations, and

-

Why and how a product or service could be better from a desirability and usability standpoint.

Specifically, market researchers want to learn more about purchasing behaviour and the best way to reach a target audience of buyers. They are focused on how to sell a product to customers. At its core, market research is about figuring out whether a product should even be brought to market in the first place. A market researcher might send out a survey to 1,500 respondents, asking about their income, purchasing patterns, and what they want to buy next, in order to capture a broad amount of information.

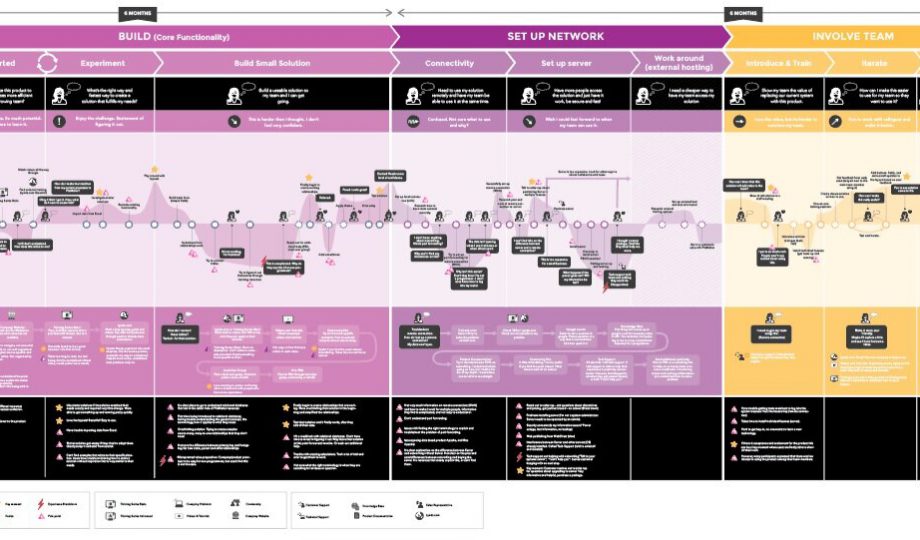

Alternately, UX research focuses on understanding the deeper interactions (good or bad) between customers and the products/services they’re already using. A company might launch a new product only to discover that, six months later, customers are unhappy with how it works. This is when a UX researcher might conduct, say, 20+ one-on-one interviews with current customers, asking them in-depth questions about how they use the product, where their pain points lay, and what needs to change going forward.

Both market research and UX research are highly valuable, but they achieve slightly different ends. Surveys are great tools for market researchers, but much less effective to really explore how customers are engaging with a company’s services or products.

The same can be said for focus groups, another common market research method used to gather customer feedback. Focus groups serve a different purpose than in-depth interviews or participatory workshops in the UX and human-centered design (HCD) worlds. While focus groups can be useful, they do have downfalls, and in our opinion user interviews are the better choice. For example, focus groups can end up favouring one or two strong voices in the group, which can in turn influence the opinions of others––or cause certain people to feel socially obligated to agree. When this happens, researchers may not hear everyone’s true opinion. Likewise, focus groups might not work well for introverts who don’t feel comfortable speaking up or speaking over other people.

A one-on-one (emphasis on one-on-one) interview with a user/customer, on the other hand, provides the individual with plenty of opportunity to express their opinion, unbiased by other thoughts and perspectives.

Benefits of Diving Deeper with UX Research

Ultimately, surveys only answer one part of the puzzle. They are great for pointing you towards an area that might need improvement, but not so great at telling you why your product isn’t working or how it could be improved. Surveys (and other market research methods) sometimes cannot provide the much-needed context to make informed decisions about your products and services.

UX research and HCD methods (like one-on-one interviews, observations, workshops, and diary studies) will enable your team to:

-

Discover areas for improvement

-

Make informed product and service decisions

-

Find innovative solutions, and

-

Delight your customers in unexpected ways!

By speaking to your customers individually through in-depth interviews (and not in focus group settings), you’ll be able to design products that anticipate your customers’ needs and speak directly to them. You’ll know exactly how and why people use your products, what’s not working for them, and what could cause them to jump ship.

As well, in-depth interviews are typically “semi-structured”, meaning they leave room for the interviewee to talk about ideas or thoughts that the interviewer might not have planned for––which can lead to new and interesting opportunities and insights!

View this post on Instagram

Click through to learn even more about user interviews…

So try to apply survey data in combination with other research methods, like interviews. You can even use answers from a survey to guide your line of questioning in interviews. Let the survey tell you which areas aren’t working and let the interviews tell you why they’re not working. Interviews allow you to probe deeper on certain topics, to actually talk to a person and ask them to get into the nitty gritty details. This is information you could never glean from a one-sentence answer in a survey.

Some UX research methods to use in conjunction with your customer surveys:

Remember, do not abandon your surveys! They are still really important for helping organizations understand, from a quantitative perspective, who their customers are and what they think of a company’s brand, product, or service. Just don’t stop there. Try a mixed methods approach to your research (get interviewing!) to reveal the richest insights that will greatly improve your user and customer experience.

Resources we like…

-

Understanding the differences between quantitative and qualitative research

-

Digital survey tools we like include SurveyMonkey and TypeForm